Climate-related risks have financial statement impacts – KPMG Study

All companies are facing climate-related risks and opportunities and are making strategic decisions in response. These climate-related risks and strategic decisions could impact their financial statements – and KPIs.

In recent years, many countries have seen dramatic shifts in the number of companies reporting on sustainability, driven not only by new laws and regulations but also by a growing understanding of the environmental, social and governance (ESG) issues which impact financial performance and corporate value. Sustainability reporting is now so nearly universally adopted, that the small minority of companies not yet reporting will find themselves seriously out of step with global norms.

“According to the KPMG Survey of Sustainability Reporting 2020, 80% of companies surveyed now report on sustainability and that number rises to 96% among the world’s largest 250 companies,” says Charoen Phosamritlert, Chief Executive Officer, KPMG in Thailand, Myanmar and Laos. “Companies that do not align with this global practice put themselves at risk. However, these companies should also be aware that sustainability strategies and reporting cannot be implemented overnight with a quick fix”

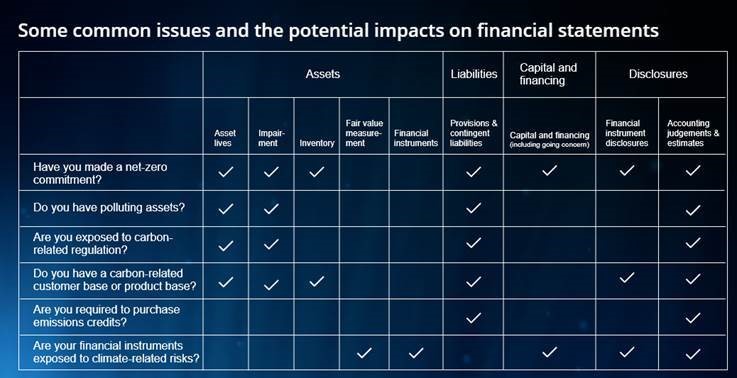

“Key points that these companies must consider when identifying potential financial statement impacts from climate change include net zero commitments; polluting assets; exposure to carbon-related regulation; carbon-related customer base or product base; requirements to purchase emissions credit; and financial instruments exposure to climate-related risks.” says Natthaphong Tantichattanon, Partner, Sustainability, KPMG in Thailand.

Even if climate-related risk may seem to have minimal financial statement impact for companies today, this may change quickly as a result of regulation, strategic decisions or shifts in climate patterns. And the decisions that companies make could affect their assets and liabilities, or they may need new financing or even a capital injection to fund the transition to new strategies.

To help companies with their financial reporting disclosures, KPMG recently launched the Climate change financial reporting resource center. It provides guidance to help companies consider how to provide clear financial statement disclosures of the significant judgements and estimates that could be materially impacted by climate-related risk.

Visit the Climate change financial reporting resource center.

ลงทะเบียนเข้าสู่ระบบ เพื่ออ่านบทความฟรีไม่จำกัด