How organisations scale their businesses with Amazon Web Services (AWS)

At the Amazon Web Services Summit 2018, an informative and educational event for better understanding on how to build tomorrow’s applications, many guest speakers were invited, including the General Manager of Amazon S3, Ms Mai-Lan Tomsen Bukovec, the Vice President of Singapore Airlines, Mr George Wang and the CEO of FinAccel, Akshay Garg.

Mai-Lan : Business People, Operations, Senior leaders can all be builders, not just developers and engineers

In the near future, inputs to application will go beyond a keyboard and a mouse to include voice, data sensors, data streaming end and Internet of Things (IoT) type of devices. Connectivity is everywhere, and user context is everything. Deployments of new applications are happening more than 20 times a day. The user experience is personalized, customized and deeply embedded in the users’ world. The combination of fast iterations and evolution will provide a better product and ideal business results.

There are digital transformations happening all over the world and many enterprises in Asia are working towards digital transformation. One example is the Stock Exchange of Thailand, where they built a whole new online trading platform that handles 100,000 users at its peak. They did it in 8 months and shaved 20-30% of their developing cycles.

Kumpuran, Indonesia’s first hybrid media platform, takes professional journalism and combines it with user generated content to deliver millions of reads to their customers. Kumpuran also saved 30% on their infrastructure costs. The most successful accomplishment that Kumpuran achieved with AWS was that they managed to cut down from 9 months of development to just 3 months of development.

Besides the services provided for cloud migration, AWS provides the experience built up over 12 years on working with different customers.

4 patterns of digital transformation

- RE-HOST - which is essentially bringing the legacy application as it is, to the cloud. It is a lift and shift. AWS have the tools to help customers life and shift their cloud migration needs. The benefit of re-hosting is that it offers customers the quick win.

- RE-PLATFORM - taking the legacy application to the cloud, but replacing different parts of the application with AWS management services.

- RE-PROVISION - essentially taking the back-office applications and putting it with the cloud environment, so as to synthesize the enterprise environment.

- RE-ARCHITECTURE - which means building the applications natively on the cloud, rewriting the application for future challenges.

In the last 12 months, AWS has launched 30 services and has worked with customers for over 10 years.

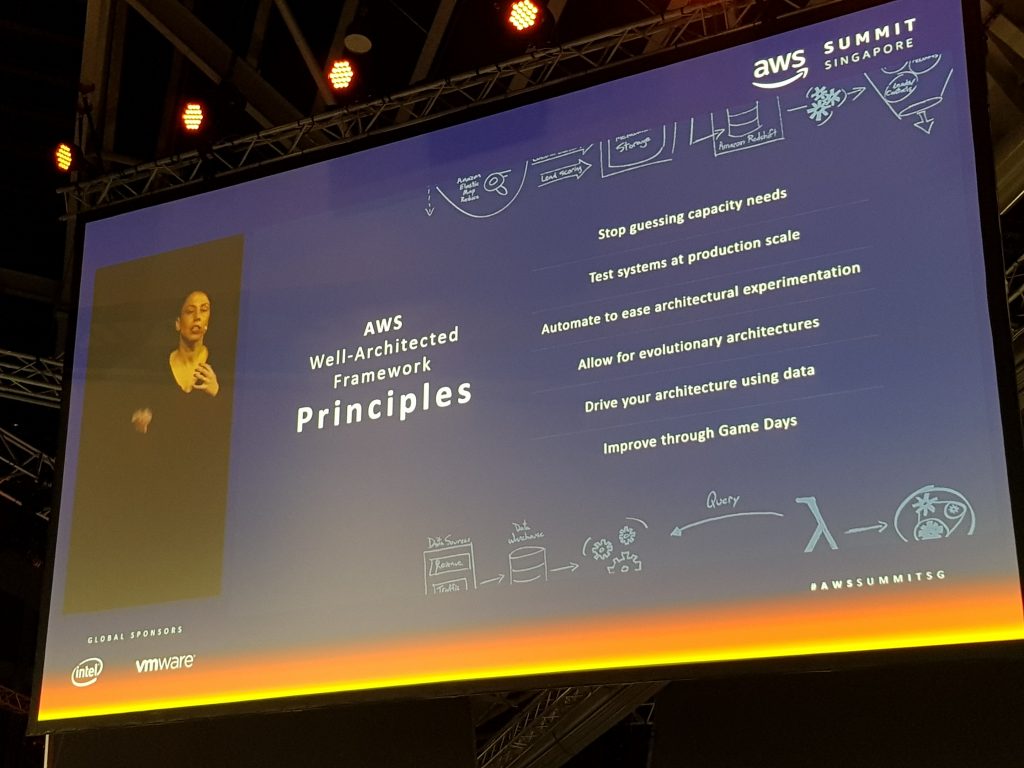

We help them reimagine their applications in a 21st century architecture. And as part of that, we’ve in place a well-architect framework. The framework consists of guidance, services, tools and best practices that helps customers in their journey.

We’ve also introduced a set of principals that are important to in building today’s application. One of them is stop guessing capacity needs and take advantage of the elasticity that the AWS provides. We did this with Involve Asia from Southeast Asia and we found that they were over-provisioning, and they ended up re-architecting their framework, adapting, servicing. After re-architecting, their overall cloud spending went down by 75%. With great performance from the 2 major E-commerce events that they ran. That combination of lower costs and high performance was very high to them. In the well-architect framework, we talked about security. There is no greater job than to protect our customers information.

Encryption : the Foundation of Data Base

AWS has 3 different ways to encrypt. You can encrypt server-side, where we keep the key. You can encrypt client-side, where you keep the key. And we have customers in financial services sector that use our amazon key management service to store the key and they keep control of it through that service.

Encryption is ubiquitous across the platform, we encrypt in transit, at rest, whether there are different storage and data base services. We manage the encryption keys in ECS and we provide the auditing tools and services like cloud trail because we know, that security is everybody’s job.

Machine Learning

Another principle is to use data to drive applications. To do that, we use machine learning (M.L) where you can use data and inferences made on that data to build smarter applications.

According to Netflix who also uses machine learning, “75% of what is watched today on Netflix is driven by their machine-learning recommendations”.

Every time you upload an image to Pinterest, it moves through different machine algorithms, where the image is access for fraud or scamming, and it is classified and streamlined to suit their advertising needs. So whereas in Netflix, the product is the show to watch. In Pinterest the product is targeted advertising, but they are all done through machine learning.

Amazon Prime Air delivers packages within 30 mins of a customer’s purchase on a website directly to their house. It uses drones and machine learning, a combination that introduces a new experience of delivery to Amazon customers. When Amazon was first coming onto machine learning, we realize that in order to have engineers all across the company, we had to learn how to build common services so that the smart people that worked on our product can take advantage of them. We created a platform internally for machine learning and now, we’ve noticed that it sparked all kinds of different ideas for applications within Amazon.com. When you have a significant data set, you often have a significant opportunity to drive learning off that data set, to help your business and customer experience.

Case Study : Singapore Airlines

George Wang : Singapore Airlines (SIA) is one of only 2 Asian companies on the Fortune 50 list of most admired companies in the world. We are the first to fly the Dreamliner 787-10. Our newly-introduced mobile app allows customers to control the in-flight entertainment system. However, whatever we’ve done in the past will not guarantee future success. Our ambition is to be the leading digital airline in the world. What differentiates us from our competitors is our commitment to excellence, service leadership and technological innovation. It’s not just implementing new initiatives and adopting new technologies. It requires a consistent effort across the company from top management all the way to front line staff.

There are 2 key components to ensure the success of our vision. The first is digitalizing from the core, across all aspects of business. The second, open innovation, Leveraging on our excellent partners like AWS, startup communities and universities.

To digitize from the core, we need to reimagine the customer’s journey. The way we sell to our customer, the way we serve our customer, the way we operate and the way we enable our employees. Here are a few examples, our mobile application is personalized for the trip and contextualized for the journey. Customers get immersed even before the trip begins, they can use the mobile app to book a ride with Grab to the airport. They can download all their favourite magazines and newspapers for free to their mobile devices before the flight.

In addition, we have developed a pilot app for our pilots which provides all the information they need at their finger-tips for their duty. This includes weather information, flight plans, schedules, rosters, changing requirements, license requirements. Gone are the days that our pilots need to carry a heavy suitcase, full of documents and manuals. Now, they just need to carry an iPad. They now can go from home to the departure gates directly, without the need to go to the airport control centre to pick up all these documents.

Our annual app challenge is one of the largest in Singapore. Through the open innovation platform, we connect the challenges that businesses face to the outside community. Concurrently, we bring the internal technology in for the community to adopt. In SIA, we have started a digital training programme for all our ground staff, including the management team. We focus on the data, the design thinking and the agenda. We are aggressively expanding our technological resources, from data scientist, data analyst, cloud analyst and many others. We are changing our operating model to be aligned with our agenda. We have been running our analytics infrastructure from day 1 on AWS. 50% of our web traffic now runs on AWS. Within the next month, 100% of our web traffic will be on AWS. Our communications centre uses AWS software such as Lambda service computing, which resolves the need for us to supervise our AWS resources. With the services from AWS, we are 16 times more efficient than before. We have also reduced the footprint of our data centre to one quarter of its original size. AWS provides us with the speed to achieve innovation and the ecosystem of partners to collaborate with.

Case Study : FinAccel

Akshay : Finaccel is a transaction payment system that combines two real time engines, one of which is a real time credit risk processing engine and the second is a real time transaction engine. We are trying to solve the problem of lack of access to retail in Indonesia. What’s interesting about Indonesia is that it is a company of 250 million people, a trillion-dollar economy but only 10% of the population is the middle class has access to any unsecure credit product from a banking institution. Which forces individuals to go to consumer finance companies. Indonesia is one of the few nations where nearly 50% of the population is below 30. It’s also a country with a very high penetration of smart phones.

When we started out, we were faced with two fundamental problems. The first was “How do we design scalable services that allows us to ingest a huge amount of unstructured data in one go?” The second problem was “How do we enable a high frequency transaction engine which integrates with E-commerce platforms to process up to a 100 transactions per second?” When it comes to unstructured data, for every individual who connects their bank account and social media, we ingest up to 30 megabytes in real time per user, on whom we get a user score and an application score in that very instant. When it comes to enabling the transaction for each E-commerce site, when the consumers are transacting, we are also computing the fraud score in real time. Enabling the customer to either buy or block that transaction to indicate that this user is very likely to default. These were pretty significant challenges at that time and we chose to host our entire operations on the AWS platform.

Our business layers are categorised into 4 major layers, the first is the application layer where you have things such as the OCR, the optical tech recognition. The second is the transaction agent, allowing the user to buy on E-commerce stores. The third is the data layer, which is computing a huge amount of data in real time. Fourthly, the integration layer, which allows us to connect to the endpoints on both sides, customers as well as vendors.

How these business layers work with the technical layers is that our firm has adopted lambda-based framework where we have utilised AWS’s API gateway to implement a serverless computing framework. Secondly, our entire data layer which is our ETL is hosted on AWS using AWS Glue, Amazon Redshift, Amazon EMR and a couple of other services. Finally, based on the way we are scaling our stack, each one of these integration lenses is being implemented or evolving into a microservices infrastructure. The result of these work is that we’ve been growing transactions and applications per month at a rate of more than 30%.

This kind of growth for a start up is practically unheard of in Southeast Asia. We’re processing and ingesting nearly 30 to 40 gigabytes per day. Our raw data is stacked now to about 20 to 22 terabytes. We’re computing real-time credit scores literally under 1 second. Finally, as we scale our stack, we are at a point where we are able to handle 100 to 200 transactions per second. This is only possible by our alliance and dependence on the Amazon stack.

ลงทะเบียนเข้าสู่ระบบ เพื่ออ่านบทความฟรีไม่จำกัด