SCBX Group Combines FinTech and AI for Net Zero Impact and Inclusive Growth

SCBX Group is committed to advancing a strategic framework built upon four key sustainability pillars: 'Digital Seed, a Society of Opportunities, an Economy for the Future, and a Sustainable Climate'. The aim is to drive access to financial and social opportunities for underserved groups, including Small-scale Entrepreneurs and communities, totaling over 6 million people by 2025. This is in line to drive towards the Net Zero target by 2050, in support of both the nation and the global community, limiting the world's average temperature increase to no more than 1.5 degrees Celsius, as per the Paris Agreement.

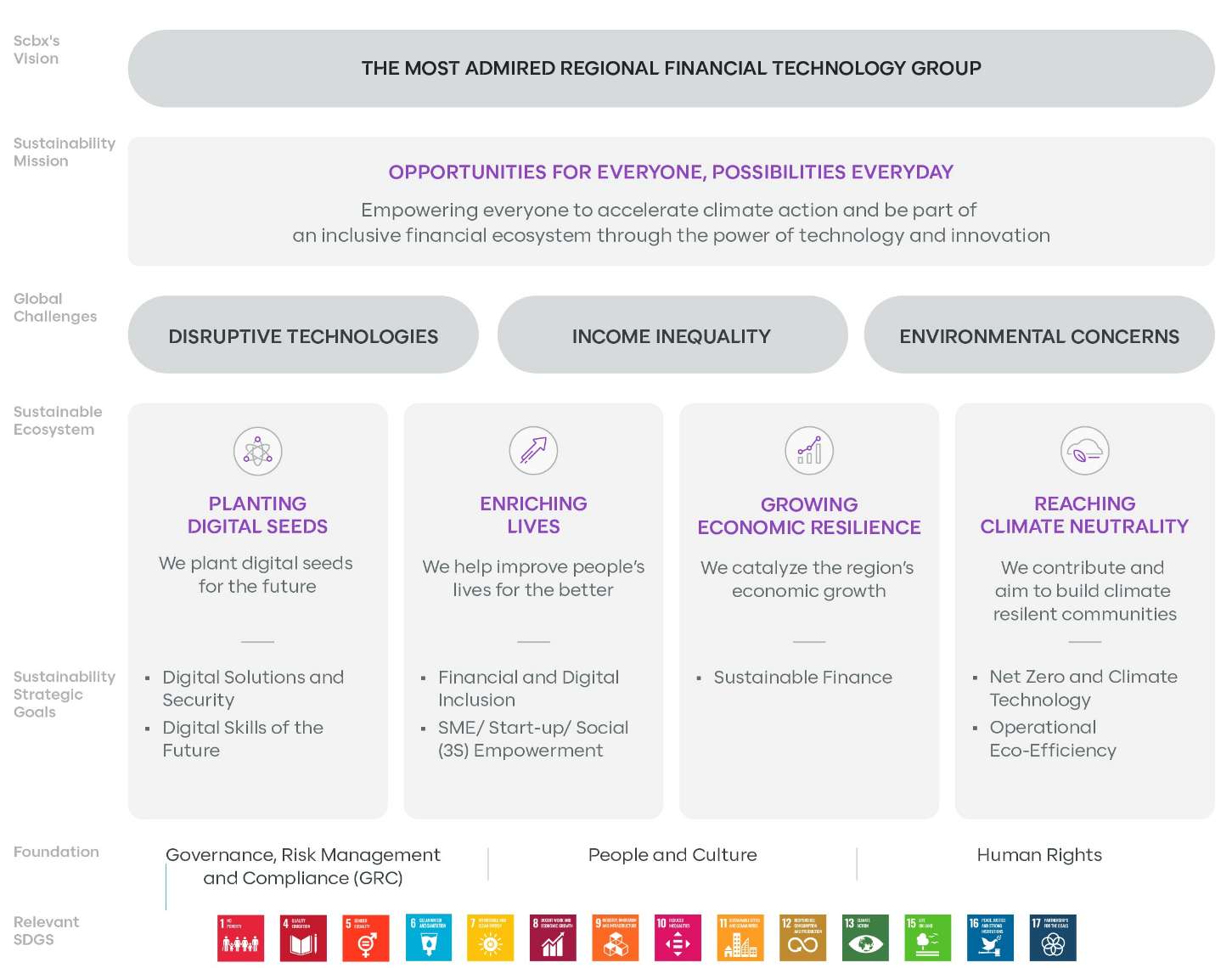

As a leading regional organization, SCBX Group recognizes its corporate responsibility toward society and the new generation, especially in the face of challenges like income inequality, disruptive technologies, and environmental concerns. To address these issues, the Group has established a strategic sustainability framework consisting of four pillars guided by the mission 'Opportunities for Everyone, Possibilities Everyday'. This framework provides direction for companies within the SCBX Group to collaboratively generate additional economic, social, and environmental value by harnessing the potential of technology and innovation. The ultimate aim is to create an inclusive financial ecosystem and support all sectors in accelerating their climate action.

Mr. Sathian Leowarin, Chief Sustainability Officer at SCB X PUBLIC COMPANY LIMITED, noted, “The Global Risks Report 2023, published by the World Economic Forum at the beginning of the year, highlights that the 'Cost of living crisis' has become the top global risk in just two short years, while 'Climate change' consistently ranks among the top three, representing a long-term global threat over the next decade. These findings underscore the urgent need for cross-sector cooperation to work toward a Decade of Action, with a focus on achieving the Sustainable Development Goals (SDGs) and limiting the global average temperature rise to no more than 1.5 degrees Celsius, as outlined in the Paris Agreement. SCBX Group firmly believes that the four-pillar strategic framework, developed with careful consideration of the business context, sustainability and climate landscape, and evolving trends, will enable the Group to manage risks and seize opportunities in both the short and long term. This, in turn, also supports the global agenda aimed at reducing inequality, eradicating poverty, and addressing the global warming crisis.”

To advance the four-pillar strategic framework, comprising seven strategic goals, SCBX Group has set forth ambitious three-year sustainability goals for the period from 2021 to 2025:

Planting Digital Seeds:

- Digital solutions and security: Invest 14 billion baht in digital initiatives and innovations and achieve zero tolerance on information security breach.

- Digital skills for the future: Foster 200,000 employee and people with digital skills for their career and business opportunities.

Enriching Lives:

- Financial and digital inclusion: Support 4 million underserved people an access to alternative digital/ innovative personal loan.

- SME-Startup-Social (3S) Empowerment: Empower 2 million individuals and enterprises with an investment of approximately 5.8 billion baht, aiming to enhance business prospects and improve their overall quality of life.

Growing Economic Resilience:

- Sustainable Finance: Provide financial support of 100 billion baht to customers participating in the low carbon/ net zero transition and promoting sustainable development.

Reaching Climate Neutrality:

- Net Zero and Climate Technology: Strive to achieve net zero emissions from operations by 2030 and from lending and investments by 2050.

- Eco-efficiency: Reduce 50% of scope 1 and 2 emissions by 2027.

Mr. Sathian Leowarin added, "SCBX Group is dedicated to reducing financial inequality among the Thai population. To this end, we are employing AI to assess digital personal loans, ensuring high accuracy and efficiency in risk analysis while swiftly approving appropriate loans based on alternative data. Simultaneously, we are driving the use of AI to enhance the operational eco-efficiency, facilitate green and sustainable finance for our customers, and promote investments that support the transition to Net Zero. In doing so, we aim to become an AI-First Organization and a Net Zero Leader."

ลงทะเบียนเข้าสู่ระบบ เพื่ออ่านบทความฟรีไม่จำกัด