What Thailand Can Learn from the Country with the Highest Density of Startups in the World

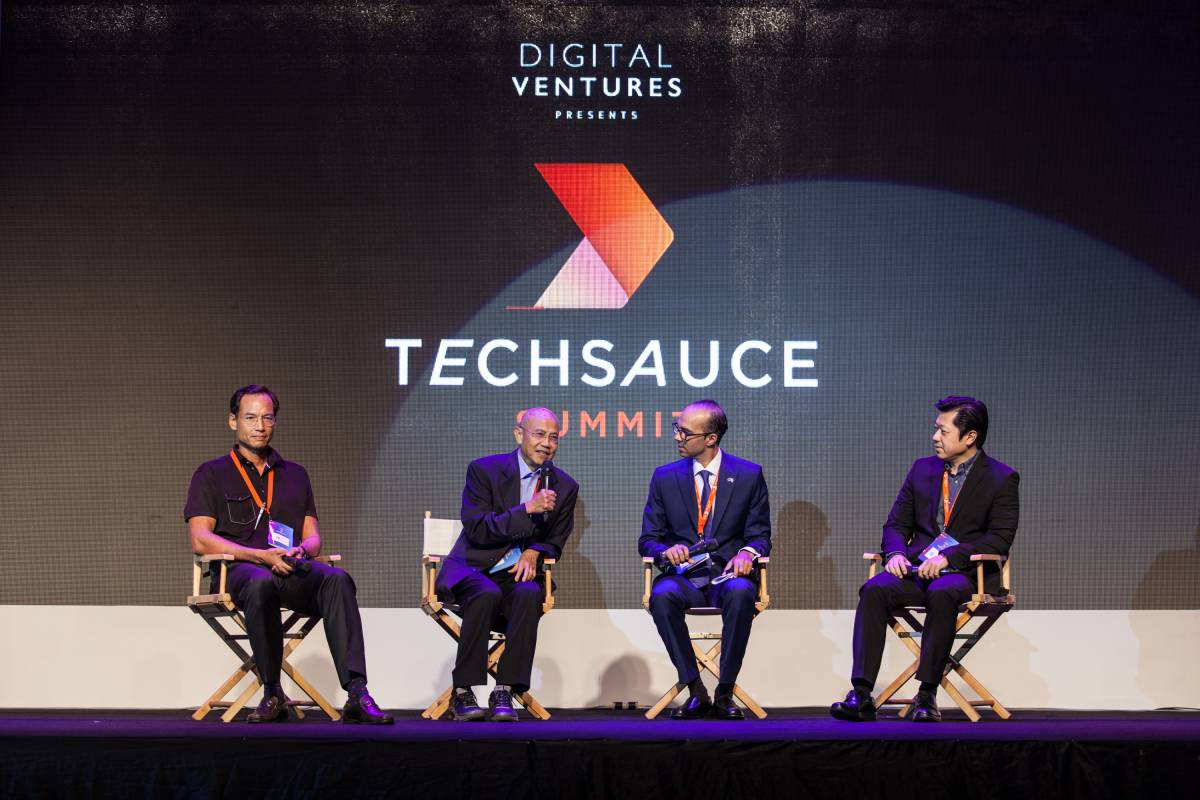

Comparing and contrasting Israel and Thailand – two countries with similar GDPs – Techsauce Summit 2016’s “big four” panel which united Thailand’s former Minister of Finance, as well as the current head of the Economic and Trade Mission for the Israeli Embassy in Thailand and the president of True Corporation PLC., together concluded that Thailand has all that Israel has in terms of natural resources, and more – but when it comes to leveraging those resources, the Golden Axe still lags far behind and the key to growth will be a shift in mentality to working smarter and creating more value-added products.

Panel Discussion with: Korn Chatikavanij - Former Minister of Finance, Royal Thai Government Suphachai Chearavanont - President & CEO of True Corporation Plc Barak Sharabi - Head of the Economic and Trade Mission, Israeli Embassy in Thailand Session moderated by Suthichai Yoon - Director of Nation Broadcasting Corporation PLC

Panel Discussion with: Korn Chatikavanij - Former Minister of Finance, Royal Thai Government Suphachai Chearavanont - President & CEO of True Corporation Plc Barak Sharabi - Head of the Economic and Trade Mission, Israeli Embassy in Thailand Session moderated by Suthichai Yoon - Director of Nation Broadcasting Corporation PLC

Contrasting Israel and Thailand’s economic landscapes

It’s worth noting that despite being a very young country and having a population of only 8 million people – only a little over one-tenth of Thailand’s population – Israel shares a similar GDP, worth approximately 305 billion US dollars in 2015 to Thailand’s 395.28 billion US dollars in the same year. [Source: Tradingeconomics.com] Not only that; Israel has the highest density of startups in the world, and in terms of venture capital, Tel Aviv is number two in the world after Silicon Valley. Is there a possibly a high correlation between having a very low population, yet high startup density and a high GDP to boot?

“Thailand has a lot of potential as the 23rd largest producer of the world,” said Mr. Barak Sharabi, head of the Economic and Trade Mission for the Israeli Embassy in Thailand.

“I believe that Thailand should take certain things from Israel, in terms of inventive capacity and creativity. You have amazing universities in Thailand – Chulalongkorn, Thammasat and others. You just need to see how to promote these people.

In Israel, we call it the Golden Triangle of government, private sector, and academia - basically these three should collaborate to support the startup ecosystem,” he said.

In the year 1993, when Israel’s cost of labor started to increase, Israel’s government established a VC fund called Yozma as an initiative and diversion for its population. With the government’s support, guidance, and finance for the private sector, a massive shift occurred. “In the 1980s, 20% of our population in Israel were agricultural workers. Today only between 1 and 1.5% of our population are in agriculture, and they produce, with their technology, three times higher the amount that we used to produce with 20%. Thailand will have to go through a shift like that. You have approximately 40% of your population working in agriculture. You need to create more value-added products and value crops. This is the food for Thailand, but you have to compete with others,” he emphasized. “You need to create more value added products, especially when Vietnam, Myanmar are creating similar products on a lower cost of labor – even if it’s not the same quality, it’s still competition.”

Thailand’s impending age crisis, and other statistics of note

Thailand faces a serious aging problem. Right now the dependency ratio, or ratio between Thais of working age and those of retirement age is 4:1 which makes us one of the more aging societies in Asia – not only that; this ratio will collapse to 2:1 in less than 20 years.

Thailand doesn’t have a lot of time left. “The math indicates you’ll either have to work twice as hard, or twice as smart – and there’s no way around it,” said Mr. Korn Chatikavanij, Former Minister of Finance for the Royal Thai Government. “I’d rather you work twice as smart, because even if you work twice as hard, that means you’ll be paying twice as much taxes because you’ll have to be looking after more elderly people. So the only way is to be smarter, increase productivity – and use technology to do it.”

Mr. Korn mentioned two other statistics of note:

- Currently, 40% of Thailand’s population is in agriculture – that’s 40% of our people working in a sector worth only 8% percent of our GDP.

- Thailand is SME dominated; over 90% of employed Thais work for SMEs – yet it is still SMEs that have the hardest access to money.

To Mr. Korn, these indicate a lot of gaps that are just the right size for startups – particularly fintech startups, who could do much to improve the economic landscape of Thailand as well as potentially mitigate the Thailand’s impending age crisis.

“I think FinTech is revolutionary,” said Mr. Korn, the former Minister of Finance, Royal Thai Government and founder of Thailand’s first FinTech club (The FinTech Club of Thailand). “In a country with millions without bank accounts, still dependent on loan sharks – there is so much that startups & FinTechs can do in reducing the cost of quality and improving quality of financing.”

He calls FinTech a very important factor for social and economic development. Though our excellent telecommunications infrastructure and high smartphone penetration have allowed better access to information, what FinTech can do is to monetize that information.

“The next step up from that is to create value from that data; that’s what Alibaba has been doing. They see all the trade through e-commerce in their system. And what they have been able to do with that is pinpoint small firms who have collected a small series of trading data and structured financial data; now, they propose microloans to SMEs – and they can be very comfortable doing that because they’ve seen payment through their systems. So they have access to this kind of personalized financing that they didn’t have before; from Alibaba’s perspective, what they’ve done is monetize that data. Part of the reason we launched the Thai FinTech club is because the data is out there, but it’s not been pulled together in a way that is accessible for those who can monetize that data.”

What Israel has that Thailand doesn’t have – yet

Can Thailand also become a startup nation like Israel? What will it take to do so? Our panelists suggested that Thailand already is on the verge of becoming a startup nation, but that the following components could help to springboard the country forward more quickly.

- Educated people – On Mr. Korn’s visit to Israel for a 1-week trip organized by Mr. Barak, he observed that whilst Israel’s landscape is not conducive to irrigation, its farmers have water 24/7, 365 days a year. “We have more than enough water but we still suffer from drought,” remarked Mr. Korn. “There’s a lot our two nations can do together. And what Israel has achieved, we can also achieve, because we have the resources. But what Israel has that Thailand doesn’t necessarily have is people who were educated in the correct field. It doesn’t mean we should have less farmers but that our farmers could be using better technology to make their work more productive and more efficient. This applies even to other sectors like telecommunications; there’s a lot we could be doing better.”

- Sense of urgency and awareness – There are many things waiting to be done in Thailand such as irrigation and logistics. While lack of resources and multiple risks forced Israel to be very strong and innovative, Thailand, as a beautiful country with the right environment and a wealth of resources, at times lacks such an urge. “Thailand is the melting pot of the region, the open spot, that attracts people from all over the world to come here, And that’s a very key thing for a startup nation. Our feng shui is right. So if we form the correct ecosystem and intensify talent around the region, we can become a startup nation. What is it Israel has that we don’t have? I think it’s the urge, the national sense of unity,” said Mr. Suphachai Chearavanont, president and CEO of True Corporation Plc.“That’s not to say that we cannot grow like Israel, but we can grow differently. Our nature is different in that we are very strong. We can jumpstart; we don’t have to reinvent the wheel. Thai people can work with foreigners, expats and young entrepreneurials around the region and we can catch up very fast. The brainpower is the same but it’s just the learning curve. It’s how we forge the cluster so that we have a cluster of communities big enough to reinforce the learning curve. We have to leverage on our own nature based on our strengths and we have to utilize that. Israel has its own strengths and nature; we are built differently but we can achieve the same result differently,” said Mr. Suphachai. He also pointed out the need to create awareness and the proper incentives. With a naturally creative culture, it will not be a challenge to stream creativity into the technology side with proper incentives such as seed funds and accelerators: “You have to show people that they can put their energy and focus on this area to grow. So government support is very important not just to attract Thai funds but from around the world, and to pursue the focus of the Thai people, including young startups in this region. It’s almost like earlier when Mr. Korn talked about the farmers – the farmers keep growing the same thing every year because they know the government gives support and guarantees the price; even if the market doesn’t want it they will still grow it. But if the government gives them incentives to grow crops according to demand, they will start shifting. Awareness must be created through giving the right incentive,” he concluded.

- High tolerance of failure – Mr. Barak pointed out that part of what makes Israel successful is its mentality: the country has a high tolerance of failure. “This is something very important,” said Mr. Barak. “The success rate is very low for startups. Many will not succeed. I believe a lot in people and execution. Even if you are failing, it’s okay. You will gain experience, and you will come back. We have what is called a ‘virtuous cycle’ – any person that is actually making money is going back to invest with his co-peers or with other businesses. You come in and you’re going to disrupt the market. That’s the most important part. You will make your country forward and stronger. This is very important. They need also you. They cannot develop everything themselves.”

Closing Thoughts

Finally, Mr. Barak left a couple of words of wisdom to the Thai startup community, and an invitation to visit Israel’s startup ecosystem and grow from it: “Israel is always here we are very good friends of Thailand, we will collaborate and support Thai startups – even if it’s with mentoring – come to Israel, we have an ecosystem. Take a chance in life, dare to do,” he said. “Finally, the government needs to make policies that will attract foreign portfolio investors (FPIs). This is the next generation of Thailand; we need to see how we can support them. Startups will help to share lot of the economic burden, so they need support.”

ลงทะเบียนเข้าสู่ระบบ เพื่ออ่านบทความฟรีไม่จำกัด