Vietnam: A Successful & Strengthened Ecosystem

With influential and strong ecosystems in more developed parts of the world, it's profoundly inspiring. When we see a country rise from economic hardship to constructing a foundation of steady and abundant means of financial stability for the startup community it inspires the rest of the continent to take note of how they achieved such growth.

Vietnam is the hot topic of the moment with institutional incubators like the Topica founder institute (TFI) which was founded in 2011. This specific organisation seeks to build real startups with real products, real revenues and real funding.

A panel of researchers, members of TFI and influencers have compiled statistics and facts that document the substantial growth and investment that can be replicated and implemented across other countries as a template and guide to empower South-East Asian emerging markets.

Since its initiation, TFI has supported 60 startup graduates, with $20 million funding raised and $100 million combined valuation. The basis of this company consists of hundreds of startups, investors, mentors promoting a 'Pay it forward' culture that has enabled the startup ecosystem.

This successful organisation has successfully invested 26% of their startups with Seed and Series A deals in 2016. A remarkable revelation is that the majority of the Vietnamese startup ecosystem benefit from regional Unicorns. This is unusual in such an emerging market as its usually heavily supported by foreign investors and outsourced sources of investment and financial influence. To have such local growth and accleeration of Vietnamese investment is crucial for the development of startups. The components that construct the ecosystem follow similar components as other successful ecosystems. With Accelerators, Series A & Series B investors, pre-seed/ seed, government and community with strong media outlets and Corporate investors.

Over the last few years, local investors bypassed foreign investors in terms of deal counts. 92 deals rose from 50 in 2016.

Among VCs & PE, 500 startups led the scene with 11 deals followed by ESP Capital.

There was a wave of ICO's, with $52 million raised by Vietnamese founded 'Kyber network', several other ICO's and Crypto - investors preparing launch.

The key areas of industries that flourished are E-commerce, Foodtech and Fintech which saw the highest number of transactions.

E-commerce rose to the top of the scene with 25 deals in 2017, approx $83M in values.

Followed by Foodtech with the presence of foody cooky and our undisclosed platform & social community related to food and restaurants at a total deal size of $65M.

Fintech stepped back to third place with 8 deals contributing to $57M.

It's evident that the backbone of this booming ecosystem for startups is the raw talent of the entrepreneurs, eager investors for a hunger to grow these products and industries quickly. Lending real support and expertise is also another factor to the success of this country.

Having the platforms of institutions that nurture the incubation of such startups create the foundational rock of stability that only encourages growth and development which is clearly working for Vietnam. These figures and the ability to have local investors as the lead financial contributors are what each country and growing, emerging market should strive for.

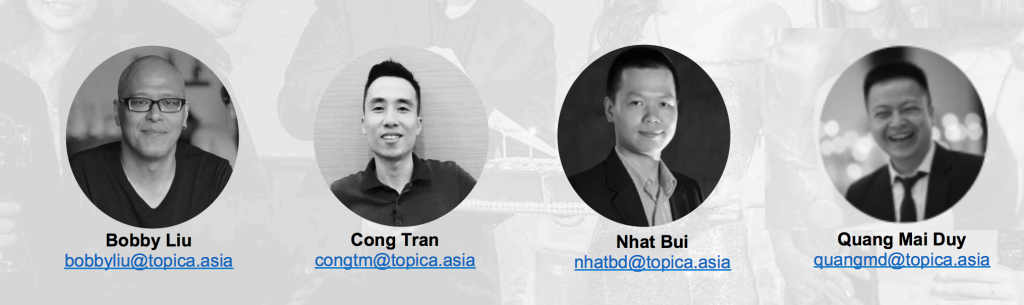

The highlights of 2017 are listed below with the panel of experts who compiled this data.

For more detailed enquires check out their website or email the panel directly:

Deal counts doubled - 92 deals, up from 50 in 2016

- The year of exits - 8 acquisitions, total $128M

- Strongest appetite - Sea Group (Garena), 3 out of 6 deals $10M+

- “EFF” - E-commerce, Foodtech and Fintech saw the highest number of transactions

- The rise of locals – First time local VCs and angels bypassing foreign investors in deal count

- Top exit investor - CyberAgent Ventures; exited 4 startups this year with Foody, CleverAds, Tiki (partial), Vexere (partial)

- Start of ICO wave - $52M raised by Vietnamese-founded Kyber Network; several other ICOs and crypto-investors preparing launch

For more information on this organisation head over to http://tfi.topica.asia/tfi

ลงทะเบียนเข้าสู่ระบบ เพื่ออ่านบทความฟรีไม่จำกัด