The ASEAN Expansion 'Disaster': VCs Decode the Downturn Playbook for Resilient Startups

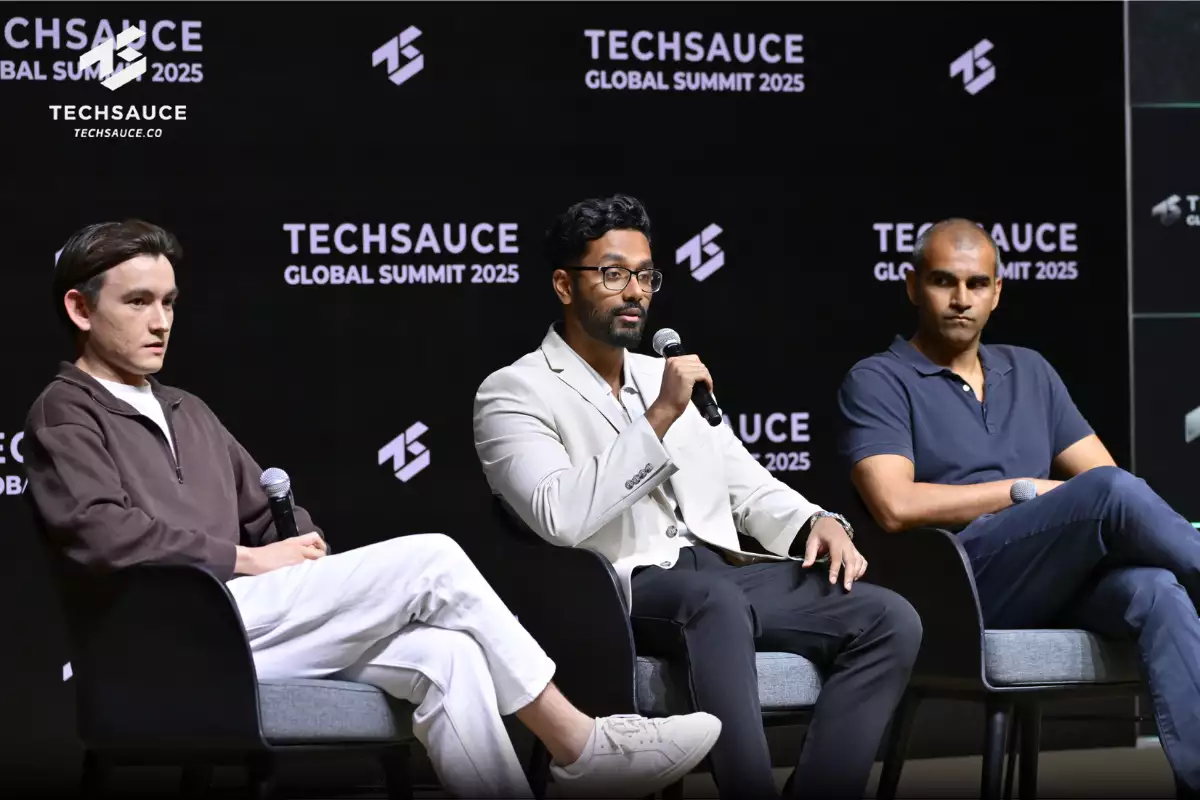

As startups grapple with a harsh economic downturn and escalating geopolitical shocks, the growth-at-all-costs approach of recent years has become obsolete. The urgent need for new, resilient startups was the focus of a recent panel discussion at Techsauce Global Summit 2025, titled "Resilience Over Hype: Startup Playbooks for Economic Downturns and Geopolitical Shocks." The session brought together leading venture capitalists from global and regional funds to deliver an unfiltered look at what it truly takes to survive and win.

The panel featured three key experts: Anmol Goel, CEO & GP of Aryan VC & Gacsym Ventures; Richard Armstrong, Partner at TA Ventures; and Arun Pai, Principal at Monk's Hill Ventures. The discussion was moderated by Paolo Rentero, Co-founder & Director of TechShake.

The Resilience Trap: Why 'Surviving' Isn't Enough

Before the panel explored solutions, they first dismantled the very concept of "resilience" as a goal. In a world of 10-year fund cycles, VCs view downturns not as a surprise, but as an inevitability.

"Economic waves will come and go," Anmol Goel stated. "If every change or, you know, every downturn is affecting you massively, then maybe you need to reassess what you're doing."

The problem, the panel argued, is that "resilience" has become a buzzword for treading water. VCs aren't impressed that a company is merely surviving; they expect it to by default. The real test is whether the core strategy is strong enough to withstand short-term shocks without constant, panicky pivots. If a business model is that fragile, the problem isn't the shock, whether from economic or geopolitic factors, it's the business itself.

The ASEAN 'Disaster': A Flawed Expansion Strategy

The panel's most counter-intuitive and critical insight was a direct assault on the default SEA startup playbook: "Win your home market, then expand to Indonesia, Vietnam, and the Philippines."

Arun Pai of Monk's Hill Ventures called this strategy a "disaster."

Who said going from Indonesia to Vietnam to the Philippines is the right option? Right. In fact, from a macroeconomic perspective it's probably going to be a disaster.

- Arun Pai

He argued that this "spray and pray" approach across a fragmented region is a capital-burning nightmare. Instead, he advocated for a "Corridor Strategy."

Using his portfolio company Delos, an Indonesian aquaculture startup, as an example, he explained they aren't expanding to Vietnam. Instead, they are finding the single most profitable corridor for their product, which means selling their end-to-end supply chain visibility directly to "a guy in the UK" (i.e., large supermarkets) who will pay 5-7x more for that validated data.

Arun Pai instead advocated for a "Corridor Strategy." Stop thinking about planting flags. Find the most profitable, specific corridor for your product and dominate it.

The Capital vs. Quality Debate: What’s Really Lacking in SEA?

The conversation then turned to why raising capital is so difficult. Richard Armstrong (TA Ventures) suggested there’s a "lack of capital" in SEA, but Arun Pai quickly disagreed. "There's actually a lot of capital," Pai countered, "I think [it's] a quality of startups issue."

The panel revealed the real issue is global competition. SEA founders aren't just competing with each other; they're competing for a global pool of capital that is being vacuumed up by "gangbuster" US startups.

"If you're seeing an AI startup going from 1 million to 10 million ARR in like six months, obviously you're going to invest over there," Pai noted.

This global competition also explains the painful valuation gap. Anmol Goel provided a stark figure: a portfolio company doing 7M ARR was pitched at a 30M valuation. "The same thing in [the] US is going to be like... 100 million."

The 'Bang-Average Product': What VCs Actually Bet On

In a market this tough, what do VCs actually write checks for, especially at the pre-seed stage when a product barely exists? The panel was unanimous: it's not the product.

Anmol Goel put it bluntly:

Any day of the week... Give me a bang-average product and an amazing team. Over an amazing product and a bang-average team.

- Anmol Goel

This is what VCs are underwriting. When investing before an MVP is even done, they are betting on the founder's ability to sell, listen, and build. Key advantages they look for include:

- Conviction: Has the founder charmed top-tier advisors onto their board before having a product?

- Customer Obsession: Goel's biggest red flag for founders? "Not listening to your customers or your clients... Many, many founders, they get too cocky."

- Execution: A great team will take that "bang-average" idea and, through relentless execution, make it great. A "bang-average" team will drive a "perfect" product straight into the ground.

The Path Forward: A Final Playbook for Founders

When asked for one final piece of advice, the panelists' answers formed a "holy trinity" for the new founder playbook, perfectly summarizing the strategic tensions founders must manage.

- Arun Pai on Focus: "The number one advice I would say is focus. You guys don't have the resources of Google or Microsoft. You have very limited resources. The only way you can achieve success is through focus."

- Anmol Goel on Strategic Fit: "Make sure you know your stakeholders well... Same with investors, right? Don't spray and pray. Figure out what the investor is looking at, figure out if the investor is worthy of being on your cap table as well."

- Richard Armstrong on Capital Independence: "Look at it as... does that get you enough to never need cash again?... If you can do that, you don't even need a VC's money... you can go to the VC and actually negotiate the best terms."

Ultimately, the discussion painted a clear picture of the new reality. The old playbook of hype-driven, regional expansion is dead. The new strategy is about ruthless focus, building capital-efficient corridors to profit, and developing a business so strong it doesn't even need VCs—which is, ironically, the surest way to get them to invest.

Based on the session: “Resilience Over Hype: Startup Playbooks for Economic Downturns and Geopolitical Shocks” at Techsauce Global Summit 2025.

ลงทะเบียนเข้าสู่ระบบ เพื่ออ่านบทความฟรีไม่จำกัด