SCB 10X Invests in Guardrails AI to Advance AI Safety and Innovation

SCB 10X’s contributions to the seed round and to Guardrails Hub underscore their conviction in Guardrails AI’s mission to advancing trustworthy and safe AI innovation, and their shared belief in the open-source approach to meaningfully accelerate AI

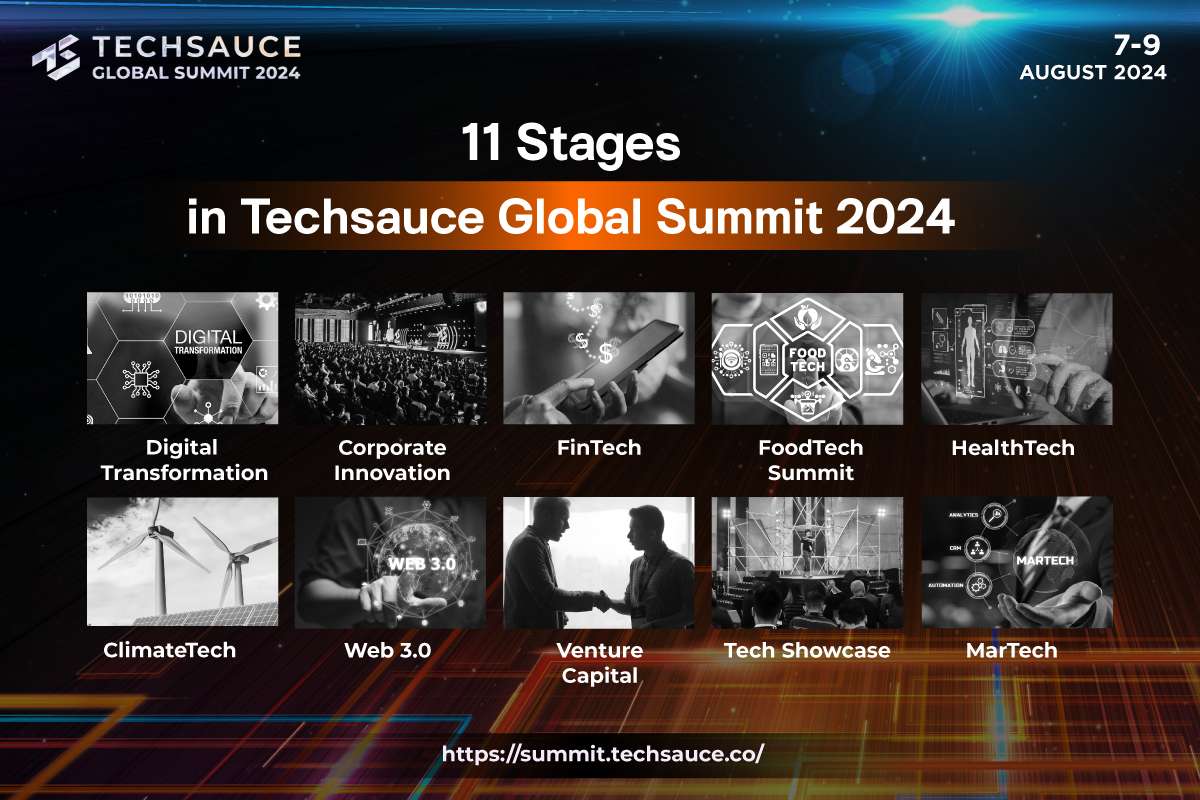

11 Groundbreaking Stages in Techsauce Global Summit 2024

Techsauce Global Summit 2024 gather all the technological business trends, holding even larger event with 11 conference stages and more than 350 leading speakers in the industry to...

HD, Southeast Asia’s Leading Healthcare and Surgery Marketplace Secures $5.6M in Series A Funding

Thailand's HD, the leading healthcare and surgery marketplace in emerging Southeast Asia, announces the completion of a $5.6M Series A funding round led by SBI Ven Capital....

RML Announces Brenton Justin Mauriello as the New CEO, Driving Thailand's Leading Luxury and Wltra-luxury Real Estate Forward

As the new CEO of RML, Brenton Justin Mauriello will succeed Korn Narongdej who will remain RML’s Director and Chairman of the Executive Committee to support the newly appoint CEO ...

Gearing Up for Virtual Banking: SCBX Taps WeBank as Tech Partner, Advancing Consortium's License Pursuit

As giants companies heat up new virtual bank licenses, SCBX and WeBank have agreed to collaborate on exploring deployment of innovative technology in Thailand, supporting the Conso...

SUBSCRIBE TO TECHSAUCE

Join our newsletter to receive update, news