Understanding Indonesia's infrastructure before running your businesses there

South East Asia’s biggest economy and large young population – over half of 261 million people are between ages 15 and 54 – put Indonesia on the spot for a lot of investors. With rising economy of 5.2% GDP growth, Indonesia has attracted numerous foreign investors, founders and business owners, being the top destination for business expansion and new startup scene, with China as the key player.

Jakarta's CBD area (Photo credit: TRVL)

Jakarta's CBD area (Photo credit: TRVL) “China is the number one priority for us in the investment board”, said Franky Sibarani, the former Head of Indonesian Investment Board. Chinese companies, both private and government owned, are eyeing to pour out capitals to help Indonesia build its infrastructure and more importantly, actively invest in rising startups with outstanding potential; not to mention the recent US$1.5 billion series E funding led by a Shenzhen-based investor, Tencent Holdings for Gojek and US$1.1 billion series F funding by Alibaba for Tokopedia.

The breaking news of these two Indonesian unicorn startups does nothing but only to spike the anticipation from entrepreneurs around the world even more. What’s more, surrounded by booming markets like Thailand, Vietnam, Singapore and Philippines, it’s just so much easier to find the society’s biggest problem, tackle it, and see the outcome faster – this region is the scene to keep an eye on next ten years down the line.

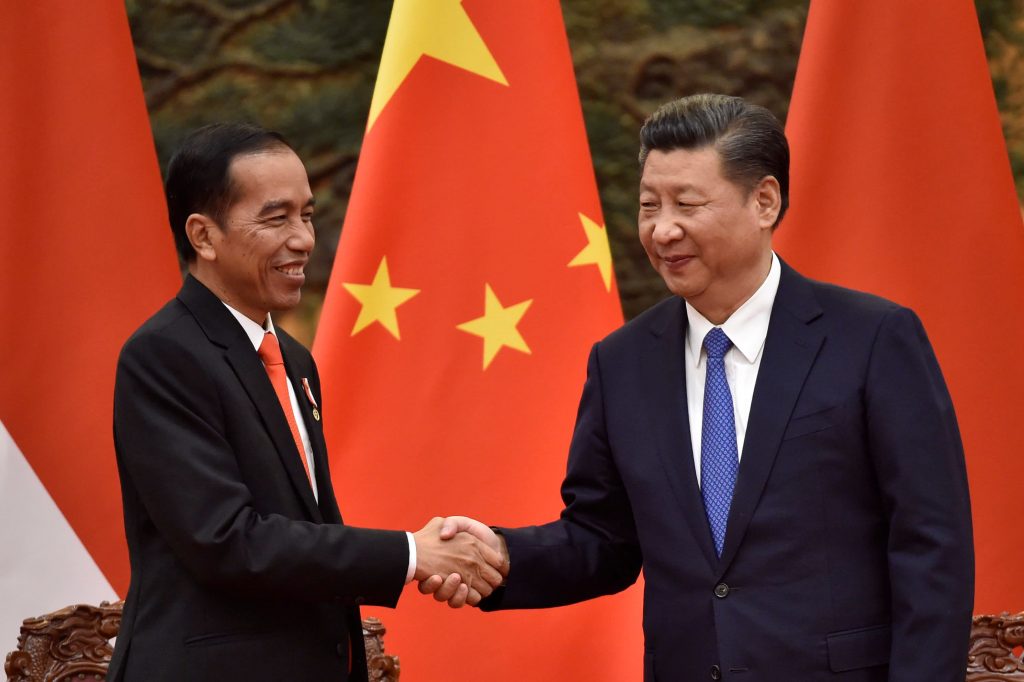

Indonesian President Joko Widodo and Chinese President Xi Jinping shake hands in Beijing when China hosted the Belt and Road Forum (Photo credit: Nikkei Asian Review)

Indonesian President Joko Widodo and Chinese President Xi Jinping shake hands in Beijing when China hosted the Belt and Road Forum (Photo credit: Nikkei Asian Review)However, a coin has two sides. Being a developing country also means Indonesia has a lot of challenges and issues, which are unavoidable by potential investors. “While there is a lot of optimism about Indonesia’s market potential, there are also a lot of problems in the market,” said William Gozali, Investment Manager at MDI Ventures, a Jakarta-based venture capital initiative by Telekomunikasi Indonesia, Indonesia's largest telecommunication company.

Let’s consider the 4 prominent challenges an entrepreneur would face when running businesses in Indonesia:

1. Logistics and transportation

Despite investment from China in building power plants, high bridges, sea ports, Indonesia still has a long way to go when it comes to logistics and transportation functionality. When you ask the locals what the first thing comes to mind when they think of Jakarta, most people, if not all, would say traffic jam; which from my experience of living there before, I can assure you it is way worse than Bangkok. This is the problem Gojek tries to tackle, but Indonesia surely needs more than that.

2. Inefficiency in business laws & regulations

Indonesia has a tainted reputation for being one of the worst countries for startups in relation to “red tape” issues where it took 52 days to set up a company back in 2014, while Singapore took only 3 days, Malaysia took 7 days, and Thailand took 29 days, according to World Bank.

However, the situation has significantly improved, and Indonesia has become more business-friendly ever since President Joko Widodo issued a new regulation to slash the investment applications processing time, establishing an integrated all-in-one application for investors to obtain the required licenses. In 2017, it takes Indonesia 23 days to set up a business – definitely a big jump from 2014.

3. Shortage of skills and women leaders

Similar to startups in Thailand and many countries in SEA, Indonesian startups also faces the challenge of finding the right employees and management board to drive forward their mission. The lack of talent comes with a greater price especially with a very low number of women leaders in businesses and political positions, straining the gender discrimination even further. In fact, Indonesia is ranked the second least literate country out of 61 measurable nations, while Thailand ranks just one place above, according to a study conducted by Central Connecticut State University in New Britain, USA. A lack of knowledge and intellectual resources can prove to be a hindrance in driving the nation and its people forward.

4. Financial technology

When it comes to payment transaction, iBanking and usage of credit cards are still very new to many Indonesians, with only 17.4 credit card users in 2017, which makes up only 6.5% of the Indonesian population, according to Eni V. Panggabean, Executive Director and Head of Bank Indonesia’s Department of Payment System Policy. Due to low banking penetration rate, most online shopping payment is still made through ATM bank transfer or cash payment upon delivery. This is one of the consumer behavior many entering ecommerce are trying to disrupt.

Regardless of the challenges, let’s see things in brighter light. Being South East Asia’s biggest economy, Indonesia offers a growing middle class and gradually increasing internet penetration. With growing numbers of knowledge sharing and awareness in the startup ecosystem, it's no doubt why Indonesia has become very attractive among foreign investors. Most importantly, behind every problem always lies an opportunity.

ลงทะเบียนเข้าสู่ระบบ เพื่ออ่านบทความฟรีไม่จำกัด